You teach your children to stay calm, think, and NOT go off on every bit of information as it comes in. Yet, we see adults and so called experts shrieking and crying, as well as gathering Paid Protestors this weekend to rail against current public policy.

The latest tariffs, the Day of Liberation, have many at the top of the pyramid angry, as their unlimited and nonstop siphoning off of dollars of the public trough is at risk. I have always been amazed at how our rulers get people to protest and post about things that they not only know very little about, but also help the .01% continue to take their money.

Using the bought and paid for Corporate Media to whip people into a frenzy is always interesting to watch. We don’t advocate for these things for our young people, yet I see, with the market dropping, adults doing what they then turn around and tell their children to not do.

This is the topic at hand - the podcast transcript is below.

It's been two days, people, and it's always interesting to watch the adults in the room, or the so-called adults in the room, react in a span of 48 hours as if they were chicken little and the sky was falling. The idea behind the tariffs is not that complicated.If you are going to have your country inundated with cheap goods coming in for necessarily free prices, a pittance of cost of goods made in what might not be, and oftentimes are not, conditions from workers overseas, and you're going to have that flood your country, then the other side of the trade should be more equal.

A friend of mine just got back from the Far East. He was in Thailand for an extended time, and being observant and shrewd, noticed things that your garden-variety, mouth-breathing American tourist did not, which was that practically everything was not only written in the native language, but also priced in the national currency and made there.And the reason why is because places like Thailand and Vietnam and other countries throughout the world have a tariff on American-made goods. So guess what? Thailand does its own thing and makes a lot of its own products and sells it within the country, and there you go.

Meanwhile, things made in Malaysia, China, Indonesia, and other places like, let's say, Mexico, they don't have to pay much.They can use workers at low rates, and then they can sell their goods here in the States with reckless abandon. To review, the American people were told in the 90s, and I remember this, that having free trade would make things less expensive and improve our quality of life because our overhead would be less, and it was all going to be good. And it was all good is what they said.

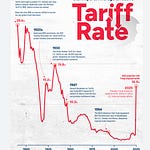

What they didn't say is the continued lowering of tariffs and the movement of labor overseas was going to hollow out these United States, a once proud manufacturing powerhouse. So if you can explain to me how a high tariff the United States 100 years ago, with low to no income tax, became a manufacturing world power, a military world power, while those things were in place, and now today, in 2025, those same rules are somehow bad. I'm listening.I really don't see it now. Just like the Treasury Secretary Scott Pesent talked about, there's going to be some pain. There's going to be a recalibration.

There's going to be some adjustment period as you bring the nonsense and unfair practices out of the system. There's going to be some kind of struggle as things balance. That's normal because for whatever reason, the corporate press has allowed Americans, many of them, to have weird feelings about Donald Trump because the stock market pain and the equity market pain has lasted all of 48 hours.You're seeing calls for a recession. You'll see people talking about their incomes and their stock market portfolios and how Trump's America is all this kind of thing.

Well, in the olden days, meaning before 2016, we would say, okay, let's wait and see about what happens.Let's wait and see how this goes. And what you have to add to the psychological brinksmanship that goes on in this current day is these moves are engineered so that Main Street finally can take a win. Because I'd like you to notice something that isn't talked about among the people who are crying and screaming about Trump and the tariffs and economics and all of a sudden they're talking about the stock market.You know, they're just bandwagon jumping.

But corporate America and Wall Street is in serious pain. And many of you have been talking about how horrible the Republicans are.That they're just stooges of Wall Street and large corporations. And they don't think about regular people. And the truth is, mainly you were right.But now you have Trump doing what you said you wanted government to do and you're angry about it. I'm a public school teacher. Many of you know this. Many of you know me personally.

My income hasn't changed.

The amount of food in my refrigerator hasn't changed.

My car payment hasn't changed.

Nor has my mortgage rate.

The fact that the stock market puked two days ago, yesterday was particularly bad, is somewhat irrelevant to my day-to-day life. And I suspect it's irrelevant to many of your day-to-day lives as well. Now, I have a brokerage account. Yeah, it looks really bad.But that account could go to zero. And guess what? I still get paid twice a month. My car payment still needs to come in once a month.My mortgage and maintenance. Like, my day-to-day inflow-outflow is not affected.

Perhaps the initial effect of tariffs, which oftentimes is a brief, although time-to-be determined, amount of price inflation, perhaps that'll change.It could be in two months. I'm like, man, these supply chain issues are sending prices up and I'm hurting. I'll say it to you.Right now, egg prices are down and I don't get destroyed anymore when I go to the grocery store. So, it's funny to watch all of these things happen and everybody reacting so quickly and emotionally instead of intellectually. One of the things

I've always spoken with high schoolers about is if they're able to watch the adults react, you often get a lesson in how not to act.Because you'll see people who don't really stop and think and they're jockeying for a post on social media or status on their Facebook account. You know, they're clout chasing. Whatever you want to call it. You'll see people act like that. Adults. And your garden variety teenager expects those people to react thoughtfully, carefully, slowly, think it through, and none of that is happening.

But you also see that with the corporate press, as always, because it's a chance to take a potshot at Donald Trump. Notice they don't take a potshot at Bessent, the Treasury Secretary. Bessent is really bright.

You should watch Tucker Carlson's interview with him and listen to him because you'll learn a lot. I know I did. I wanted to know what the baseline motives were for tariffs over the next, let's say the Trump administration, let's say the next four years.Because I'm not looking out for myself in the first place. I'm looking out for my family first place. I'm looking out for my 16-year-old, the older girls.You know, they're young adults. I wanted to know what was going on. And it doesn't bother me that Tucker Carlson used to work at Fox News because I don't use that kind of brainless label to limit my knowledge base.

Tucker Carlson, by the way, was fired by Fox News quite a while ago now, in effect, because he wouldn't toe the party line and just repeat what the globalist, New World Order wackos who run Fox News wanted him to say.

So they fired his ass.

But good luck trying to explain that to your garden variety progressive these days who, after finishing dyeing the tips of their hair magenta and putting on their problem glasses and holding up a sign, can't get past their own feelings.So this is the kind of thing that we're dealing with now. And it goes hand in hand with what I spoke and wrote about with you guys previously about gold. You're seeing a couple of things happening that are long-term, thoughtful trends in the world of making good financial choices.

Gold went down with everything else. But it's not just still over $3,000 an ounce. And interestingly enough, Bitcoin, of all things, something I don't talk about that often, is still over $80,000 per Bitcoin.Last time I checked, which was 10 minutes ago, it was $83,000 per Bitcoin.

Whereas the rest of the stock market, most notably the MAG7, the Magnificent Seven, the seven companies that have been propping up, the S&P 500, the major stock market gauge, Nvidia, Tesla, Microsoft, these huge companies, Google, Facebook, Apple. So they're just getting slapped around.But gold and Bitcoin took a dive, but not that much. And that says a lot that the slower, maybe more thoughtful way of thinking about things is the better way to go, and not listening to the emotionally fraught talking heads on social media or in corporate media.

And these are the general concepts that used to be part of the education system by rote. This is stuff that was always talked about as things you should look at in the ways, the philosophies of learning and how to learn instead of the current way of what to learn, where they say, hey, look at this. How do you feel about this? And of course, it'll be something like tariffs or orange puttler or whatever the topic of the day is.

Then that is so-called teaching or instructing young people. I don't go for that. I don't do that, even if it's stuff that I don't necessarily politically or economically like.It's always been beneficial to not only teach teenagers, but instruct myself that maybe I should just sit back and instead of letting my emotions roll through my system and rule the day, it's quite a bit better to sit back, watch what happens and see how things go over the long term.

So the 48 hours now of tariffs that hit on Thursday, today is Saturday. We've got time to see how that goes.We're going to have to revisit this over the next couple of weeks and months because I'm wondering if at the end of June, what's going on with the economy, sentiment in the stock market and investing, things like that. But every day is a new day and we're blessed to be here and we should feel grateful to be here.

I know I do, especially of the events of the last couple of months and even the last two and a half years or so.So let's connect again soon, compare notes, see how we can all navigate this complicated and goofy world together and just go from there. Let's keep the conversation going because that's the most important thing.

Below is the Scott Bessent interview with Tucker Carlson. It is a useful look into the rationale for the current Tariff regime:

Share this post